Why are nightclubs underinsured?

Insurance equals reassurance. If the worst happens and you need to make a claim, your insurance policy is there to make sure your business stays afloat if disaster strikes. However, not being totally honest and upfront with your insurer will have consequences. Even inadvertent omissions can lead to you being underinsured – and this is a big problem.

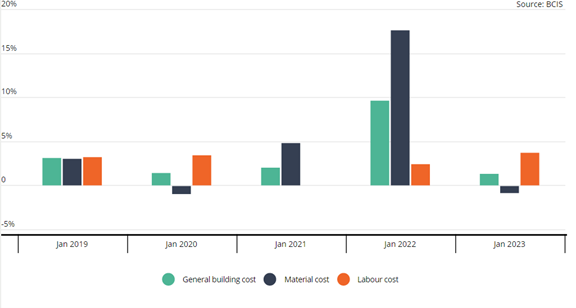

The risk of underinsurance have been exasperated by inflation. Inflation has increased the cost of goods and services and will up the compensation required for any theft, damages or rebuild. An increase of over 10% in construction costs from one year to the next is a significant jump with potentially significant ramifications. This jump will put at risk the Sums insured of businesses, even if their policies were written recently.

Indeed, costs are expected to increase throughout the rest of the year, if at a lower rate. The significant increased rate of inflation in 2022 married with what has been experienced over the last 18 months, the damage has been done and many nightlife businesses hsould expect to now be underinsured if they have not had a recent valuation.

What does being underinsured mean?

Underinsurance is where the amount you are insured for is less than the correct value of your property. This can encapsulates rebuild costs and costs of materials and labour for repairs, each of which are often overlooked. Underinsurance means the insurer will only pay a percentage of your claim; the more underinsured you are, the more you have to pay out.

Underinsurance is the failure to declare exactly how much it would cost to fully cover potential losses if the worst-case scenario became a real possibility. 50% of UK businesses and 80% of UK commercial properties are underinsured. What’s worse, ¼ of UK small businesses would close if they had an unexpected £50,000 bill. Which is likely if they had to make a big claim – and they turned out to be underinsured.

One of the most common reasons for underinsurance is miscalculating the cover needed. So make sure you know your stuff when it comes to working out how much it would cost to get your business built back up. If in doubt, call in the experts.

The ramifications of being undervalued before a period of inflation is even worse, we’ve seen examples of SMEs being underinsured by as much as 27%. The longer you’ve left your valuation, the worse your situation could be.

We recommend that all our clients arrange a comprehensive building valuation at least every three years. This is because insurers and insurance brokers are not able to advise on how much to insure your sums for. You’ll need a RICS qualified Chartered Surveyors to help.

Fill out the form below to request a discounted eValuation from our partners at Barrett Corp Harrington.

Will being underinsured affect my policy?

Insurers will never pay more than the Sum Insured or Limit of Indemnity.

What is a Sum Insured? : Sum Insured is how much it would cost to reinstate and rebuild your venue, not just the market value.

If you choose not to insure your buildings at the correct reinstatement value, then your insurers will apply Average in the event of a claim. This means that any settlement would be reduced in proportion to the amount of underinsurance. This applies to ALL claims – not just total losses.

To apply Average the insurer will divide the Sum Insured total by the valuation and deduct the excess. The premises will then have to find the remaining amount to pay for the underinsurance.

So, for example…

Venue Y has a Sum Insured of £720,000 and a reinstatement valuation of £1,370,000

Venue Y has a relatively serious fire which totals a loss of £300,000.

£720,000 / £1,370,000 = 52.55%

Sum Insured is 52.55% of the reinstatement valuation so the claim payment would be 52.55% of the total loss

£300,000 x 52.55% = £157,650 less the policy excess of £250 = £157,400 paid by insurers.

The business now must find the remaining £142,600 from their own funds to pay for the underinsurance.

How can I make sure I’m not underinsured?

NDML work in close partnership with a Chartered Surveyor who can undertake a valuation of your premises at a competitive rate. To chat to us about your policy, give us a call.

Factors to consider in your Sum Insured cost:

– The whole premises everything

And we mean everything… Internal features, outbuildings, car parks, boundary walls; this is not an exhaustive list. We don’t recommend a DIY approach for this, and a Chartered Surveyor will be able to help you.

– Include debris removal

Identification of asbestos in a building can significantly increase the cost of debris removal at the time of a claim. This should be taken into account in your Sum Insured costings.

– Don’t forget demolition and professional fees

Think about clearing the damaged structure and the professional fees associated in its re-building. You shouldn’t think of the replacement cost as the total it would cost to just buy a new building – reinstatement and its associated cost is totally different.

– Understand Building Regulations and Legislation

Additional features (i.e. lifts or disabled access) may have to be installed during reinstatement due to new regulations, even though they were not there prior to the loss.

– Consider Green upgrades

This covers increased cost of repairing or replacing damaged property using “green” materials and methods. This generally means it’s good for environment – sustainable and energy efficient.

– Identify Listed status

Reinstating a Listed building can have huge ramifications on cost due to the requirement to source original materials.

– An inventory or an asset register

This helps identify the quantity and value of stock, plant, machinery and equipment stored in your premises.

– Do you have any obsolete equipment?

If an item is difficult to replace, the cost of its replacement may be much higher than you may expect.

– Add VAT

Knowing whether to include Value Added Tax on the insured amount is a complex one depending on whether you are VAT registered (including your VAT recoverability status). To avoid being underinsured, seek the advice of a VAT specialist.

– Consider inflation

It could take several years before reinstatement or rebuild is complete. As it’s almost impossible to predict the inflation, it’s recommended to adding in a provision for inflation to your sum insured.

– Let your insurer know about any changes

As your business grows, so will your stock. Perhaps you’ve invested in new equipment or altered/extended the property? This will all alter your Sum Insured, and you’ll need to let your insurer know as soon as possible.

– Are there any exceptions?

If your building could be classed as “obsolete” – maybe you’ve set up a nightclub in an old building or your hotel has been a family business for decades – then it may be more economical to demolish the building and replace it with a modern one. This is a specialist cover and should be discussed with an insurance broker.

What is Declaration Linking?

This is a form of cover to help minimise the effects of Business Interruption underinsurance. Essentially, customers with this type of cover will be eligible to receive up to 33% uplift on the declared revenue or profit. So if there is a delay in getting things back up and running again then there’s a bit of leeway.

What is Business Interruption insurance?

You’ll need to also cover your business for loss of financial earnings caused by any damage. This doesn’t just take into account how long it will take to rebuild or repair your premises. It’s how long it will take your business to fully recover to the position it was in before the damage. So if, for example, it takes longer than expected to source materials or to rebuild parts of your premises you won’t be left worrying about timescales, deadlines and a dwindling cash flow.