Support the #CutTheDancefloorTax campaign

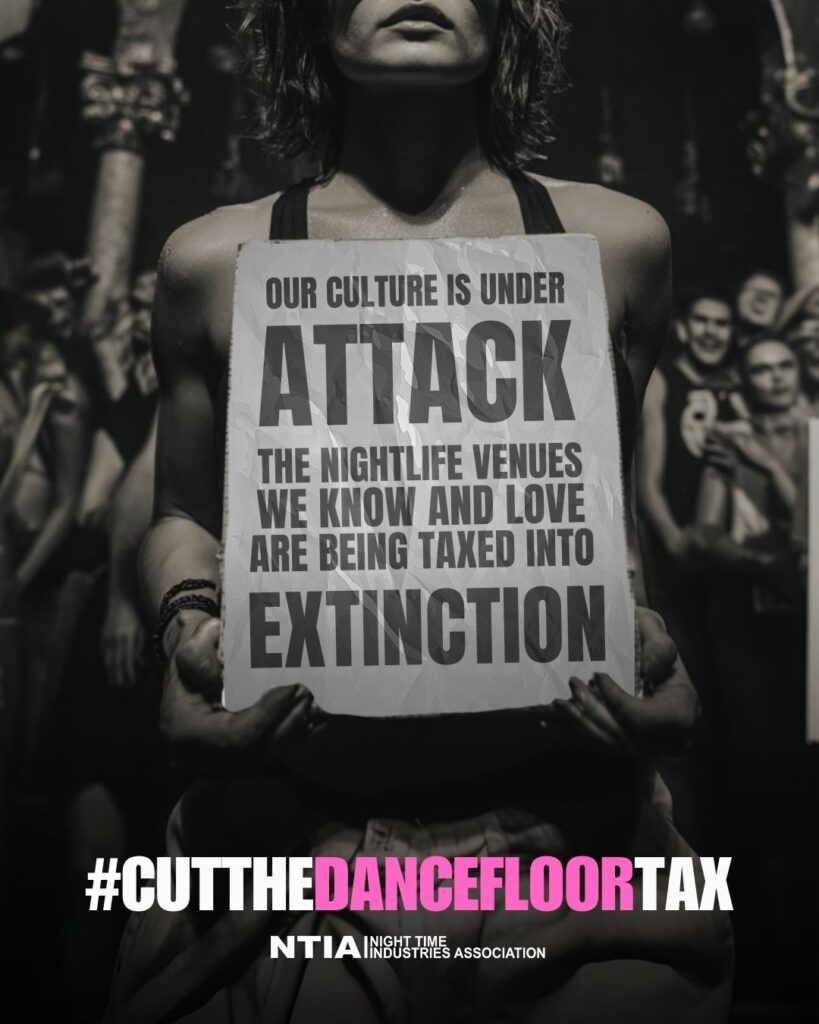

Since 2020, 26% fewer towns and cities in the UK have a nightclub. We all know of longstanding nightclub or hospitality venue that has had to close in the past few years, slowly diminishing the community hub that once brought locals together. Areas which have been stripped of their culture, hospitality and nighttime offering have been dubbed the new moniker of “night-time deserts”. One of the most challenging factors, tax.

The NTIA, as well as other leading industry figures, are calling for nightclub owners and supporters to back their latest campaign which looks at the taxation on nightclubs and late night music venues. The aim is to protect UK nightclubs, protect jobs and protect the nighttime culture.

What does The Dancefloor Tax mean?

The dancefloor tax is the taxation and costs impacting nightlife businesses and live music venues, which are deemed as unfair and contributing to the mass closures of venues across the country. There are three specific areas which, if changed, would significantly benefit nightclubs and similar businesses.

- VAT for Hospitality needs to be cut – Urgent VAT cuts are needed to stagnate the rate of closures. Hospitality currently has a 20% minimum VAT. Losing its relief post-pandemic. Any cut, to 12.5% or 10% would benefit business margins and survival.

- National Insurance Threshold for Employers – Because of recent tax changes, nightclubs and consumers are paying more tax. Reviewing the threshold will put more money back in the pocket of employers, ease hiring pressures, and help out customers, in order to boost spend and reinvestment.

- Reform on Business Rates – The Government has signalled relief, but they say transforming the business rates system is a multi-year process. Hospitality is in desperate need of relief, with the expected reduced multipliers to take action sooner rather than later.

How could the Autumn Budget affect Nightclubs?

The NTIA posited that the most recent budget added between £30,000 to £80,000 in extra costs per venue this year. UKHospitality has reiterated its call for the Government to apply the maximum possible discount for hospitality’s business rates at the Budget.

According to NTIA statistics: More than 89,000 jobs have been lost since October 2024. 7 of 10 venues are losing money, and nearly 800 venues have closed in the last 5 years. 3 venues shut every week – The government needs to exact change in order to stifle this decline.

The budget is set to be announced by Rachel Reeves, Wednesday 26th November. UKHospitality has announced for nightlife business to expect bands depending upon revenue and for existing relief to fall away.

Too long has the hospitality industry been over taxed compared to other sectors. Alternative challenges, such as cost-of living pressures, rising safety concerns, and the poor late-night transport network has also added to the reduced footfall.

What you need to do to support the #CutTheDancefloorTax campaign

Use #CutTheDanceFloorTax in your socials and press releases to support the campaign. Write and email to enquiries@ndml.co.uk and express your thoughts and we’ll publish them for you. Contact us here.

The NTIA are urging operators and supporters to take urgent action. Support the #CutTheDancefloorTax campaign by writing to your MP. Write and highlight your concern for the welfare of nightclub venues and nightlife culture. Find easy to follow instruction here: