Hospitality Closure statistics for the last 12 months look bleak

CGA’s Hospitality Market Monitor for July 2023 shows just how far the hospitality market has fallen in the last 12 months. At NDML we want to highlight some statistics to help readers gauge the crisis currently crippling the hospitality and late-night sector.

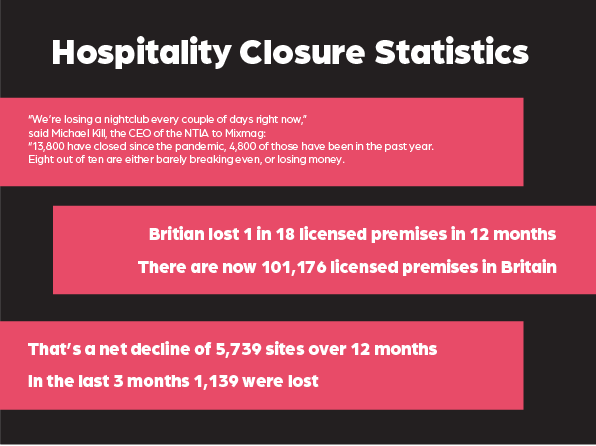

- There are now 101,176 licensed premises in Britian in June 2023

- Net decline of 1,139 sites over 3 months

- Net decline of 5,736 sites over 12 months

- Britian has lost 1 in 18 of licensed premises

These statisatics reflect the long-term downward trend since 2013, one that was dramatically accelerated by COVID and it’s backlash. Yet the problem only seems to be getting worse.

Overall, across the whole hospitality market, there was a -1.1% contraction over the last quarter. And hence, if this accelerating downward trend continues, the total number of licensed venues will drop from six figures to five for the first time.

This has had a drastic effect on job losses. Bloomberg noted that since 2023, 700,000 workers were lost in the past six years. 393,000 jobs have been lost due to COVID and the pandemic. Hospitality was by far the worst hit sector in this time, commanding 43% of the national total of job losses. Additionally, just over 78% of those leaving the hospitality payroll re under the age of 35, and then more than half being 25%.

76.5% of closures have been in the independent sector. This surprising majority shows why businesses like NDML, who understand the importance of independent venues and fight to support them through adversity, stress to highlight these figures. Independent hospitality venues are critical to the outlook of our cities, towns and villages, and they must be protected.

Which type of hospitality venue saw the largest drops?

The top five declining types of hospitality venue were:

- Nightclubs -12.2%

- Restaurants -7.2%

- Sports and social club -6.5%

- Large venues -6.3%

- Casual dining restaurant -5.6%

- Bar restaurant -5.1%

Topping this list is the nightclubs sector. Worryingly, the nightclub sector has been on an increasingly steep decline post and pre pandemic, as the sector has been consistently contracting for over a decade. The stats reflect a longer-term change in consumers’ late-night habits.

The decline of late-night venues

Between March 2020 and June 2023, Britian lost 30% of its nightclubs

The independent sector has been worst hit, 33% of independent nightclubs now gone

The nightclub sector is half the size it was ten years ago

Yet, club closures have now bottomed out. The last quarter showed a marginal growth of +0.9%

What the nightclub stats reflect, and the marginal growth indicates, is that it’s only the unsustainable clubs that have been lost. Supply is now much closer to demand, and those clubs that are sustainably responsibly run should prosper.

The overall quality of the clubbing experience is now far higher, as the consumer-ship demands a great level of service.

One inference made by CGA is that “while consumers no longer visit clubs in the volumes they did, many of them have not ditched their late-night habits but simply switched to bars or pubs. Others are going out earlier in the evening and choosing alternative experiences like competitive socialising venues, instead.”

What is causing nightclubs and bars to close?

There are numerous challenges facing nightclub owners and bar operators. These challenges existed prior to the pandemic, having been exasperated since and compiled; many nightclubs have either struggled to adapt or could not sustain their finances. Below are the most striking challenges facing nightclubs, causing pressures to mount and closures to take place.

- Increasing cost of energy

- Increasing cost of food

- Increased cost of labour

- Lack of government support or financial aid

- Larger staff numbers required

- Interest rate rise

- Consumer confidence and spending drop

When pressures such as these are added together, it’s no surprise we are seeing a drastic number of closures. “We’re losing a nightclub every couple of days right now,” said Michael Kill, the CEO of the NTIA to Mixmag: “13,800 have closed since the pandemic, 4,800 of those have been in the past year. Eight out of 10 are either barely breaking even, or losing money. That’s the flash poll figure we’ve got.”

How can nightclubs and bars avoid closure?

By getting a dedicated independent broker. As the leading independent insurance broker, NDML will offer a range of services to support your business.

Our first aim is to save you time and money by learning your needs and requirements, and arraning the most appropriate insurance policy. We will look at your claims history, see if you have any outstanding claims or payments, and provide a plan on how to become more favourable for insurers.

Additionally, as an independent broker, you will always have the same account handler handle your case – building a relationship with you and understanding your needs. They will be able to update you on industry regulations or sector changes specific to your business and help you be best prepared for the future. Our risk management service is ideal for business who require non-insurance related matters, such as disciplinary procedures, contracts, payment policies, or lawful procedure. Our risk management team are on hand 24/7 and send out monthly newsletters providing advice on current legislation and commercial law.

As a client of NDML, you also have access to our partners and the service they are able to provide. Whether that is HR and health and safety outsourcing, wellbeing and staff welfare improvements, trade associations, networking opportunities, or improved energy costs with an energy broker.

Whether you’re a nightclub, bar, pub or restaurant, get in touch with NDML to gain that extra support. Contact NDML for a personal recommendation to each of these organisations and start upgrading your business today.